Strategies for a financially stress-free holiday period

Christmas holiday breaks are a time to spend with family, friends & have a chance to recharge for the year ahead. We look forward to warmer weather and finally setting up an out-of-office email for the break. However, for business owners, this time can be stressful without careful cash flow planning. Even if you do continue to operate through the holiday season, your customers' financial behaviour may not remain the same.

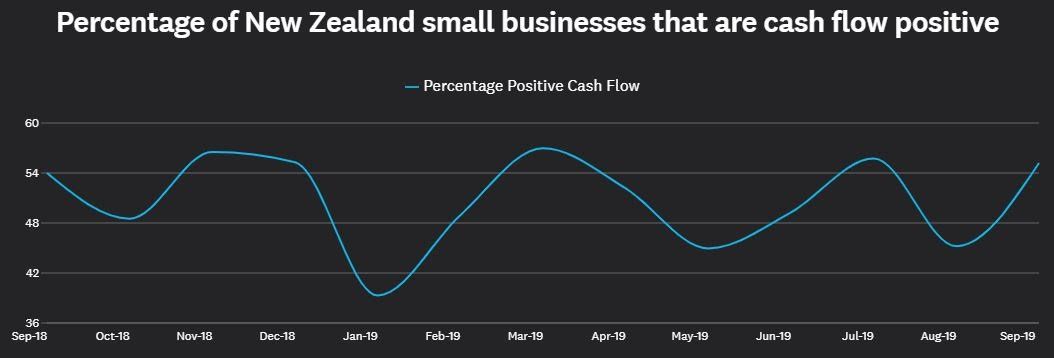

It can be pretty tough working long hours all year only to find that once you have paid everyone else, there's limited cash for your time off. The below graph highlights that impact on NZ businesses that are generally cash flow positive throughout the year (2020 may have put a spanner in the works though!).

Notice the sharp drop in January - don't let this be you! We can help you manage this January impact.

Why is cash-flow planning particularly important at this time of year?

Staff leave needs to be covered in addition to your normal fixed overheads like rent, creditors and tax compliance. The budget and forecasting process ensures you know your numbers and are prepared. If you are shutting down, you won't be driving revenue during this period and sales may take time to get started again in the new year. Here are some simple strategies that can help:

- Decide your Christmas and holiday break dates – confirm these with staff, customers and suppliers.

- Budget and plan for annual leave – remember the pay rates may be higher than standard hourly rates, also factor in statutory public holidays.

- Payroll - remember that your staff still need to be paid throughout the Christmas break. You may be able to set up and schedule your pay run before you go on leave.

- Review your work in progress (WIP) - plan to complete jobs or services that can be invoiced and paid before Christmas (remember if you don’t invoice and get paid before Christmas, you may not see the money until late January or after).

- Invoice reminders - over this holiday period, there's no harm in sending out or scheduling invoice payment reminders to go out before the invoice due date. This gives you a better chance of getting paid on time. See a reminder of how to set these up in Xero HERE.

- Chase outstanding debtors - Follow up your outstanding debtors with a reminder, statement or even a personalised email. Sometimes that is all the prompt they need to make that payment. Focus on the largest and longest outstanding invoices.

- Allow debit and credit card payments via Stripe or GoCardless - these are payment services that connects with accounting software such as Xero and enable your clients to pay their invoices with a debit or credit card. You can set it up to pass on the transaction fees to your customers, so that you don't lose out. Set up Stripe HERE or set up GoCardless HERE. There is even the option for your clients to auto pay recurring invoices via these methods, so that they can set and forget, and the payments will automatically be made to you on the due date.

- Stock-take - Do you need to order in goods now to be able to complete work in progress, or before your suppliers close for the holiday period? Check that there is stock on hand available.

- Confirm your tax payment obligations - if you find you are not able to make payments by the due dates, it is possible to purchase tax and pay it off at your convenience. There are costs associated with this, however it may provide a solution that gets you through the holiday period. We are Premium Partners with Tax Management New Zealand (TMNZ) and can offer you an IRD-approved service that lets you choose how or when you make provisional or terminal tax payments. The benefit of doing this is that you save around 3% in interest (compared to if you don't set up an arrangement), there are no late payment penalties, and you continue to meet your tax obligations with the Inland Revenue. Contact us for more information.

- Review cash movements - in order to see your cash flow movements in Xero, you can run a Statement of Cash Flows report. You can choose the periods you want to compare, whether to produce GST inclusive or exclusive figures, as well as other customisable options. Read further instructions on how to run and customise this report HERE.

Do you want a more accurate picture of your cash flow movements?

We highly recommend setting budgets and forecasting your future cash flow, so that you are prepared. Spotlight Reporting is perfect for this purpose, producing visual representations of your cash flow situation now and in the future. We can work with you to complete a budget or cash flow forecast. Just let us know. Read more on

5 reasons why you need a cash flow forecast.