Xero Tip of the Month: eInvoicing

Are you ready for eInvoicing?

It's time to wave "goodbye" to paper invoices and say "hello" to faster and easier payments through the implementation of eInvoicing! eInvoicing is a new way of invoicing that offers a more efficient and streamlined way to manage invoices with less manual handling and processing.

eInvoicing is now available on Xero and is included in all Xero Standard plans, so you don't need to purchase any additional add-on or external service to use it.

What is eInvoicing?

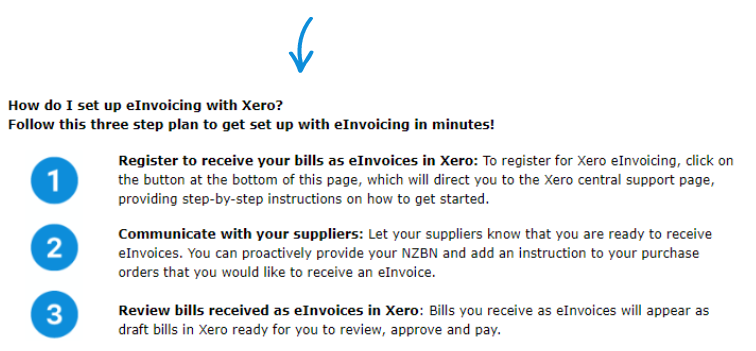

Invoicing software like Xero lets you exchange invoice information directly and safely between buyers' and suppliers' financial systems, even if these systems are different. How eInvoicing works:

- A supplier's financial system generates an invoice for the buyer.

- The invoice information passes through the eInvoicing network, where it validates information like NZ Business Number (NZBN).

- The invoice information is passed to the Businesses' financial system where it is coded and approved and is then ready to be paid.

What are the benefits of eInvoicing ?

With eInvoicing, your business will no longer need to receive paper-based or PDF invoices that have to be printed and will no longer need to manually enter these into your financial system. eInvoicing improves accuracy and security, reduces process time, and speeds up payments.

eInvoicing not only provides economic benefits - it saves the environment, too!

What is the difference between traditional invoicing and eInvoicing?

Traditional invoice processes can be time-consuming. As you can see in the image below comparing the two systems, there are several steps involved in the traditional invoicing system vs the new. An automated invoice payment processing system like Xero eInvoicing gives you the ability to speed up the invoice processing time and streamline your systems.

Is your business already using email to bills?

If you have already gone 'paperless' and are using Xero's Email to bills functionality, eInvoicing will speed the process up even more by sending bills straight into Xero Draft bills without the need for you to email them.

Need help? Give us a call today on 04 970 1182 and we'll talk you through the process so you can start reaping the many benefits of Xero eInvoicing.